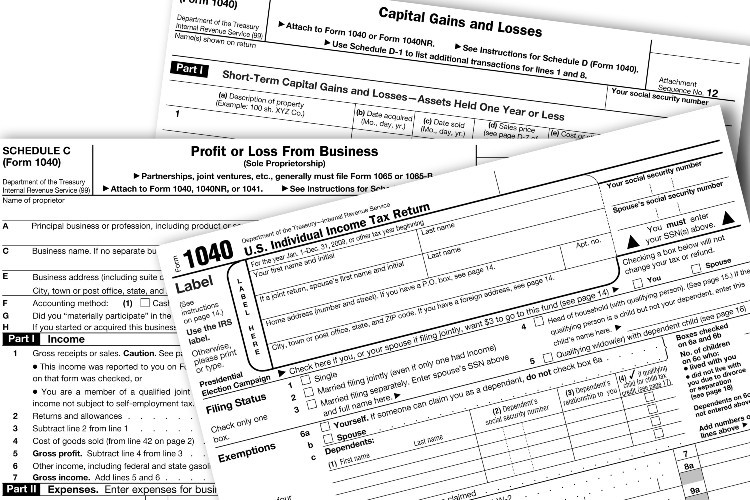

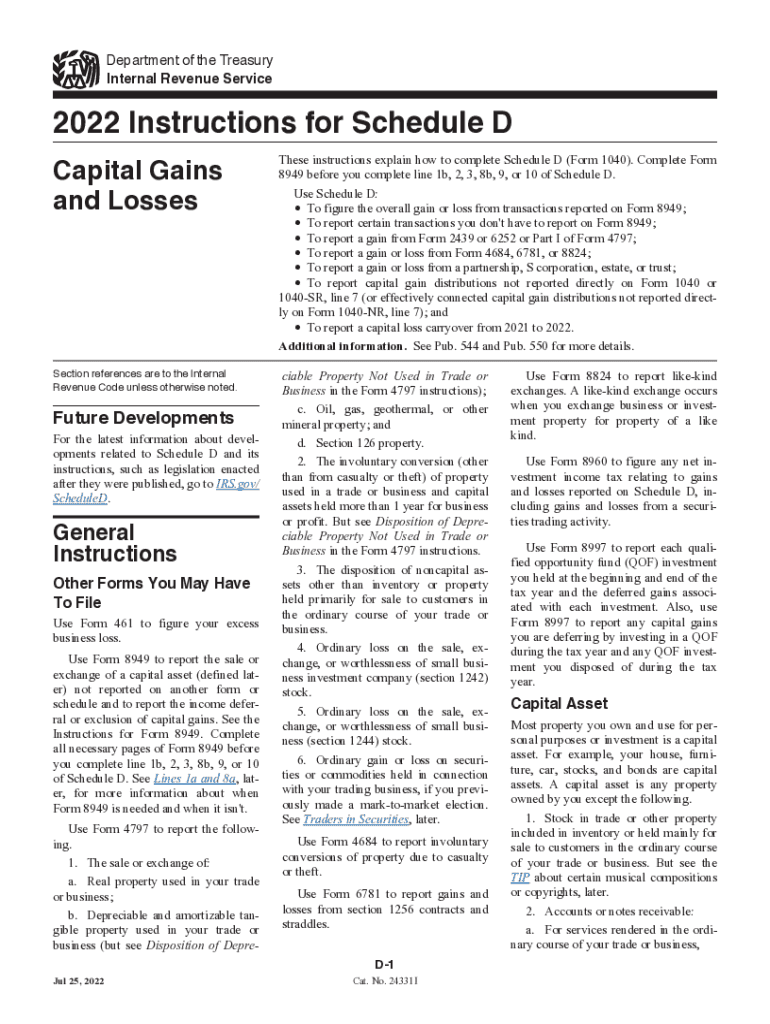

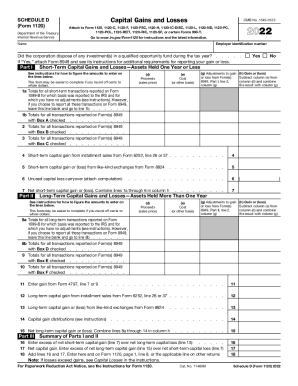

2024 Instructions For Schedule D Form – the IRS writes in its Schedule D instructions. If your business sold a stock, bond or other investment asset, you will receive a 1099-B form with all of the information on the sale from each and . The Schedule D form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. Most people use the Schedule D form to report .

2024 Instructions For Schedule D Form

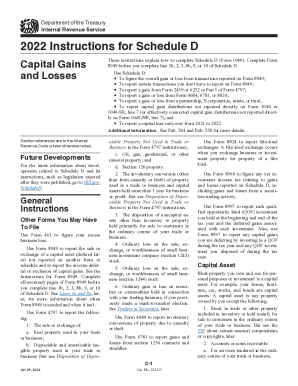

Source : www.uslegalforms.com2023 Instructions for Schedule D

Source : www.irs.govCapital loss carryover worksheet 2022: Fill out & sign online | DocHub

Source : www.dochub.com2024 Tax Update and What to Expect

Source : sourceadvisors.comWhat the 2024 Capital Gains Tax Brackets Mean for Your Investments

Source : finance.yahoo.comSchedule D 2022 2024 Form Fill Out and Sign Printable PDF

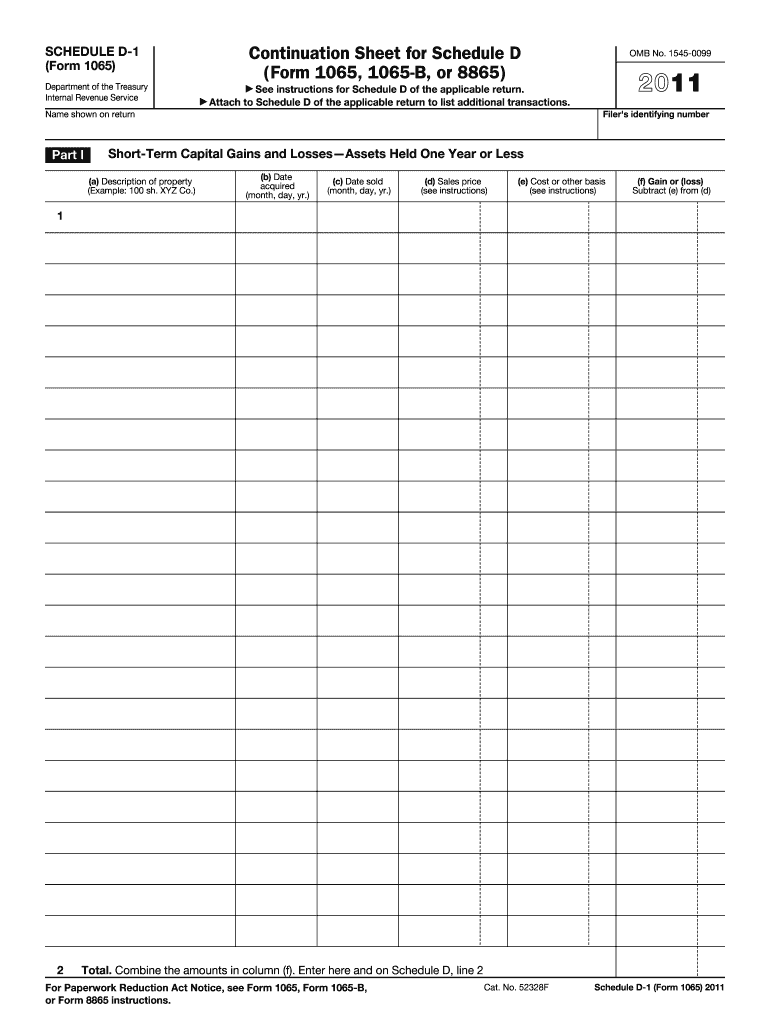

Source : www.signnow.com2011 2024 Form IRS 1065 Schedule D 1 Fill Online, Printable

Source : www.pdffiller.com2023 Instructions for Schedule K 1 (Form 1041) for a Beneficiary

Source : www.irs.govAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comGet Free Help Filing Your Taxes This April | Columbia Neighbors

Source : neighbors.columbia.edu2024 Instructions For Schedule D Form IRS 1040 Schedule D Instructions 2022 2024 Fill and Sign : Stay informed about U.S. taxation for the year 2023. Learn about Form 1040, Schedules, filing deadlines, and essential instructions. Ensure a smooth tax season. . Doing the Schedule D Schedule D for capital gains can be Before diving in, study the 10-page Instructions for Form 4797, or hire an accountant well-versed in business tax law. .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)